How To Get Money From An Annuity

Key Takeaways

- Annuity withdrawals take roughly 4 weeks before you receive your cash. Cashing out a structured settlement involves a court approval procedure which takes almost 45 to 90 days. Selling time to come payments offers more flexibility.

- There aren't whatever surrender charges or early on withdrawal tax penalties for selling structured settlement payments.

- Both withdrawing annuity funds and selling structured settlement payments result in paying taxes on the coin received.

Timing is a big factor in choosing when to tap into your annuity money. Depending on when yous purchased it, it might brand sense to withdraw funds from your annuity, assuming your contract allows this. If you purchased your annuity recently, selling future payments may exist a wiser option.

Unlike people who bought annuities as part of a financial or retirement plan, structured settlement recipients are non allowed to withdraw coin early. Only yous still have options, including selling time to come payments.

Or, if you haven't yet received your settlement money, you may qualify for a type of cash advance to embrace expenses while y'all expect.

Getting Cash Now From My Annuity

Annuities provide a reliable stream of cash over a menses of fourth dimension. Just your financial needs can modify in an instant and may cause you to reevaluate your annuity. This is specially true in cases of medical or financial emergencies and new business concern opportunities.

Early on withdrawals usually come with expensive revenue enhancement implications and surrender fees. Penalties tend to decrease over time, so if y'all wait several years, you lot may confront lower fees.

But what if yous can't afford to expect because you demand cash now?

You may get more money past selling payments on the secondary market instead of making withdrawals from your annuity account. Selling payments tin provide flexibility and immediate access to a large sum of cash that you can invest in other financial vehicles or use to pay off long-term debt.

Expand

Reasons for selling an annuity include:

- Chore loss

- Medical emergency

- Lifestyle change

- Annuity inheritance

Reasons for Selling Your Structured Settlement

What is the Process for Cashing In My Annuity?

Rather than waiting years to receive their payments, some people cull to sell their long-term income products.

At that place'south a short just set procedure for doing this:

- Enquiry Annuity Purchasers

- Start by shopping around for the right annuity buyer. Beware of unethical practices and fraud. Trustworthy annuity purchasers will take positive reviews, offer free quotes and avoid high-force per unit area sales tactics.

- Get a Quote

- Your quote should take a low discount rate so you get to keep as much of your money as possible. The average disbelieve rate ranges betwixt 9% and 18%. The current value of your annuity depends on sure factors, such as the size and frequency of your payments.

- Submit Your Paperwork

- One time you receive a quote, you must complete paperwork to allow buyers to access your annuity contract. Y'all'll demand to provide identification, revenue enhancement forms and other documentation requested past the purchaser or insurance company.

- For Structured Settlements, Nowadays Your Case Before a Judge

- If yous're selling a structured settlement, there is i more step. A brief hearing to obtain court approval of your transfer must take place. Federal and state laws have this safeguard in place to ensure all the details of your transaction are fully disclosed and to make sure the sale is in your best interests.

Once the sale is approved, you lot will receive a lump sum of cash from your structured settlement.

How to Find the Nowadays Value of an Annuity

How Long Does It Accept To Cash Out an Annuity?

Annuity owners tin can receive their greenbacks within an average of four weeks. This time frame depends on the annuity blazon, the insurance company and the purchasing company.

A structured settlement sale tin can take longer due to the required court approval step, which can take betwixt 45 to 90 days.

Pro TIP

Make certain you practise due diligence to avoid condign the victim of an unethical company that preys on uninformed sellers. You can find annuity purchasers through insurance agents and annuity brokers who connect buyers and sellers.

You Can Become Greenbacks Today Without Giving Up All Future Payments

When information technology comes to selling your annuity, you take options. You can sell the whole thing, or you can sell the right to some of your future payments.

Selling a portion of your annuity is more often than not washed by either forfeiting payments for a set up fourth dimension menstruation, say one to iii years, or selling a specific dollar amount for a lump sum.

Expand

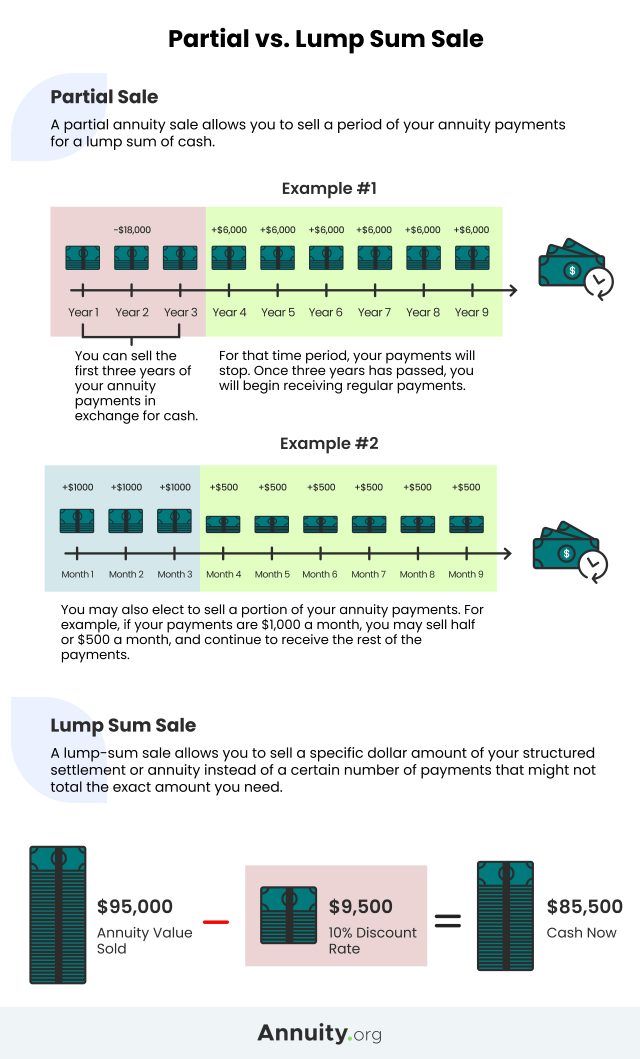

Partial Auction

A partial annuity sale allows you to sell a period of your annuity payments for a lump sum of cash. For example, you tin sell the kickoff three years of your annuity payments in exchange for the money y'all want for a down payment on a new dwelling house.

Throughout that fourth dimension span, your payments will stop. Once 3 years have passed, you will begin receiving regular payments.

Yous may also elect to sell a portion of your annuity payments. For example, if your payments are $ane,000 a month, y'all may sell one-half or $500 a calendar month, and proceed to receive the rest of the payments.

Lump-Sum Sale

A lump-sum auction allows yous to sell a specific dollar amount of your structured settlement or annuity — $10,000, for instance — instead of a certain number of payments that might not full the exact amount you need.

For the partial and lump-sum options, the annuity retains a cash value. If, at a subsequently date, you run into some other circumstance where you cannot wait for scheduled payments, you can contact the funding company to sell additional payments. These flexible selling options allow yous to tailor the transaction to your needs, taking simply what yous need.

Cash Out Your Future Payments

Cashing out your annuity or structured settlement can assist you exist better prepared for a variety of financial situations.

Why Yous're Not Receiving the Total Value for Your Annuity

When someone purchases your hereafter payments, information technology's not a dollar-for-dollar commutation. Why is that? Because the overall value of your contract — say $100,000 — is only worth that amount over a long menstruum of fourth dimension. This tin be explained past a concept chosen the time value of money, which states that a dollar in manus now is worth more a dollar in hand subsequently due to its interest-earning potential.

Factoring companies use discount rates to account for this discrepancy in value and make a small profit for giving yous greenbacks up front end. For instance, if yous wanted to sell annuity payments worth $10,000, and the factoring company has a 10% discount charge per unit, you lot would receive $9,000 in cash.

Factoring companies calculate the discount using fluctuating variables that include:

- Demand for their services

- Interest rates

- Inflation

- Fourth dimension investment

When Annuities and Structured Settlements Can't Exist Cashed In

Some annuities don't qualify for sale. These include annuities in tax-qualified retirement plans and straight-life annuities, which stop paying out at the annuitant's death. These cannot be sold because the number of payments is not guaranteed.

Often Asked Questions About Cashing Out Annuities

When can you withdraw from an annuity without penalization?

In most cases, you must meet specific criteria to avoid withdrawal penalties:

- Showtime, subsequently y'all reach 59 ½ years old, you would no longer have the IRS-issued punishment for withdrawals.

- Secondly, check to see if your contract allows for an early withdrawal without penalization during the surrender flow. If not, then you would accept to withdraw after your surrender period ends — which is outlined in your contract by the insurance company — to avoid their fees.

Structured settlement payouts are subject to a disbelieve rate or an administrative charge imposed by the purchasing visitor.

Can all annuities be cashed out?

Yeah, nonetheless, different annuity types accept varying rules and limitations. For example, structured settlement sales require courtroom approval, and country and federal regulations oftentimes govern pensions funded by annuities. Speak to your insurance company or financial advisor for cash-out options for your specific annuity.

When practice you have to withdraw from an annuity?

The IRS mandates that annuitants begin receiving a minimum almanac withdrawal amount for qualified annuities on the date they plough seventy ½, or 72 if you reach 70 ½ afterwards Dec. 31, 2019.

Withal, in that location are reasons to sell your annuity sooner than required, such equally:

- Making a major life purchase

- Paying off credit-card debt

- Paying off medical bills

- Financing a higher education or paying student loans

- Funding a divorce

- Paying for a funeral

Please seek the advice of a qualified professional before making financial decisions.

Last Modified: Apr 25, 2022

2 Cited Research Articles

Annuity.org writers adhere to strict sourcing guidelines and utilise merely credible sources of information, including authoritative financial publications, academic organizations, peer-reviewed journals, highly regarded nonprofit organizations, government reports, court records and interviews with qualified experts. You tin can read more about our delivery to accurateness, fairness and transparency in our editorial guidelines.

- Avraham, R. and Sebok, A.J. (2018, April ten). An Empirical Investigation of Third Party Consumer Litigation Funding. Retrieved from https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3137247

- Fisher, D. (2018, March 19). Study on consumer lawsuit loans finds loftier rates, confusing terms. Retrieved from https://legalnewsline.com/stories/511365351-study-on-consumer-lawsuit-loans-finds-high-rates-confusing-terms

Source: https://www.annuity.org/selling-payments/cash-out/

Posted by: varnelllestout1989.blogspot.com

0 Response to "How To Get Money From An Annuity"

Post a Comment